UPT Perpustakaan UM

Ebook dan Ejurnal yang dilanggan *

*Informasi cara akses silakan klik disini atau dapat dilihat pada akun Sipadu UM.

Surat kabar dan majalah elektronik yang dilanggan**

**Informasi cara akses silakan klik disini

Jejaring

Event Perpustakaan

JoVE Webinar

Date & Time:Selasa, 23 April 2024, 10.00 WIB Topik Webinar:Nursing, Medical Sciences, terutama anatomy dan physiology. Relevan dengan topik biosciences, dimana anatomy dan physiology memainkan peran penting. FREE Pendaftaran : https://bit.ly/JoveMedic [Dengan...

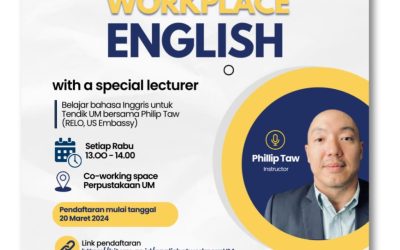

Tingkatkan Kemampuan Bahasa Inggris Anda di Lingkungan Kerja!

Apakah Anda ingin meningkatkan kemampuan bahasa Inggris Anda secara praktis di lingkungan kerja? Yuk, ikuti program "Workplace english, Boost Your Skills with Phillip Taw" yang diselenggarakan oleh UPT Perpustakaan UM. ✨ Apa yang Anda dapatkan dari program ini:...

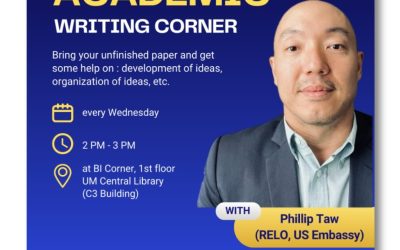

Academic Writing Corner with Phillip Taw from RELO US Embassy

Stuck with article, paper or thesis? Don’t worry guys. Academic Writing Corner with Phillip Taw from RELO US Embassy will help you to solve the problems😊 ⏰: Every Wednesday, 14.00-15.00🏢: BI Corner, 1st floor, UM Central Library (C3 Building). Simply bring in your...

Akreditasi Perpustakaan

Event UM

Terakreditasi oleh Perpustakaan Nasional

Alhamdulillah. Segala puji bagi Tuhan Yang Maha Kuasa, perjuangan Tim Penyusun Borang, Pimpinan serta Bapak dan Ibu Tenaga Kependidikan UPT Perpustakaan Universitas Negeri Malang membuahkan hasil memperoleh akreditasi dengan predikat AKREDITASI A.

Penerimaan Mahasiswa Baru Tahun Akademik 2023/2024

Universitas Negeri Malang (UM) merupakan salah satu dari beberapa perguruan tinggi terbesar dan tertua di Provinsi Jawa Timur. UM Memiliki 8 Fakultas beserta 120 Program Studi. Ayo kuliah di UM!

Berita Terkini

Library-date dan Fungsinya Bagi Sivitas Akademika

Oleh : Alvandha Adindra * Library-date belakangan ini menjadi sebuah istilah yang populer di kalangan milenial dan juga Gen Z. Walaupun telah dikenal sebagai sebuah istilah populer, tidak jarang juga menjadi pertanyaan yang akan dilontarkan oleh siapa saja yang jarang...

Bersihkan Hati, Wujudkan Kolaborasi: Perpustakaan UM Gelar Halal Bihalal Sambut Hari Raya Idul Fitri 1445 Hijriah

Kota Malang – Suasana penuh senyuman dan saling sapa nampak di UPT Perpustakaan Universitas Negeri Malang (UM) yang menggelar acara Halal Bihalal dalam rangka menyambut Hari Raya Idul Fitri 1445 Hijriah di Aula Utama Perpustakaan UM pada hari Kamis, 18 April 2024....

Selamat Hari Bumi Sedunia 2024

Selamat Hari Bumi Sedunia. Earth Day. 22 April 2024. Bumi kita masa depan kita.

Jam Layanan

- Senin – Kamis : 07.00 – 18.00

- Jumat : 07.30 – 11.00, 13.00 – 15.00

- Sabtu : 08.00 – 15.00

Alamat

Jl. Semarang 5 Malang 65145

Jawa Timur – Indonesia

Gedung

Rak Baca

- Lantai 1 – Buku Reserve

- Lantai 2 – Buku dengan Kode 000-338.99

- Lantai 3 – Buku dengan Kode 339-999.99

- Lantai 3 – Buku Oversize

Lantai I

- Ruang Sirkulasi (Pengembalian dan Perpanjangan, Peminjaman Mandiri (07.00-18.00)

- Ruang Serial dan Informasi Terseleksi (07.00-18.00)

- BI Corner (07.00-18.00)

- Ruang Reserve (07.00-18.00)

- Ruang Internet Gratis (07.00-18.00)

- Ruang Tata Usaha (07.00-16.00)

- Mushola

- Ruang Pengadaan ,Pengolahan dan Perbaikan

- Ruang Co-Working Space

- Ruang Rapat

Lantai II

- Ruang Reference dan Karya Ilmiah

- Ruang Internet Lesehan

- Ruang Quiet Zone

- Ruang Baca

- Ruang Aula

Lantai III

- Ruang Baca

- Mushola

- Ruang Multimedia/Audio Visual

- Ruang Multi Platform Digital Library